Client

A Tier-1 Exchange

Scaling a Yield-Bearing Stablecoin to $200M+ TVL for a Tier-1 Exchange

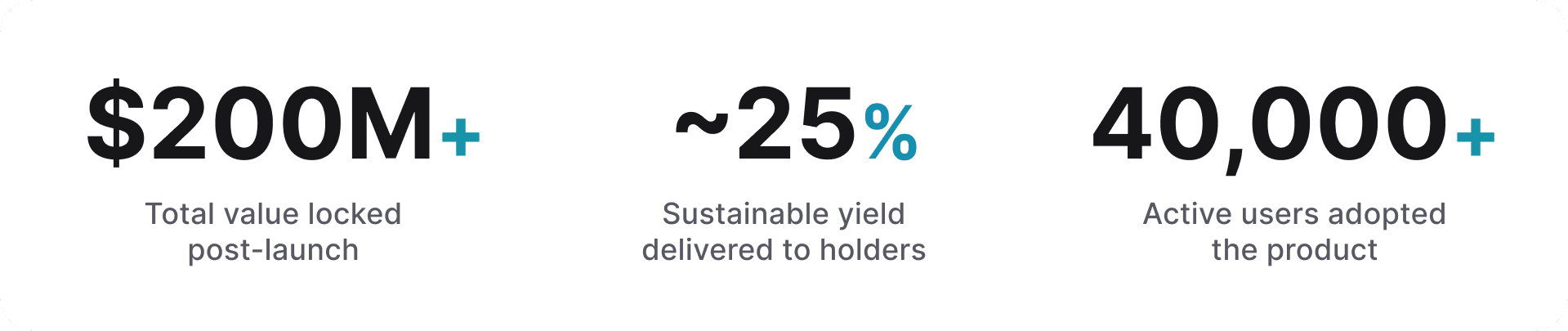

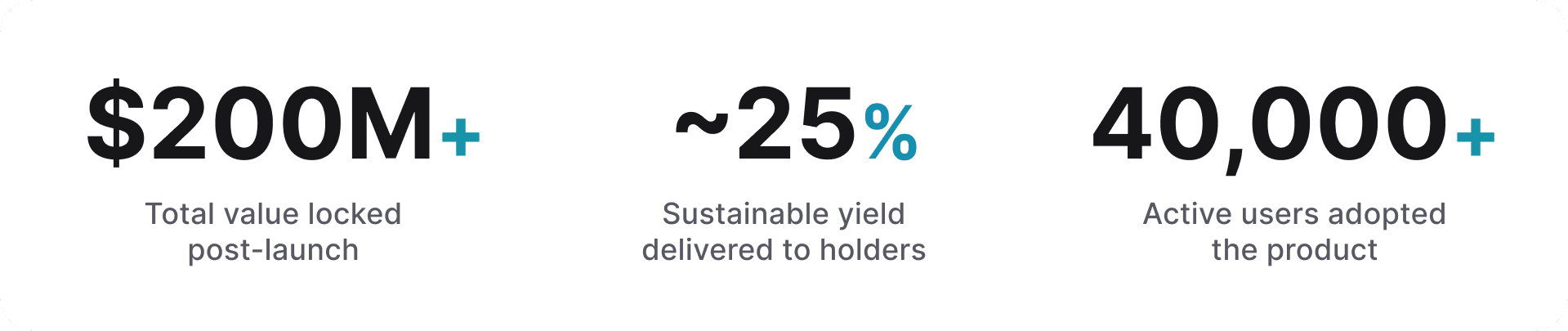

A Tier-1 decentralized exchange scaled a yield-bearing stablecoin to over $200M in TVL while maintaining price stability and institutional-grade risk controls.

Overview

We partnered with a Tier-1 exchange to architect and launch a next-generation Yield-Bearing Stablecoin. By harmonizing institutional-grade risk management with innovative yield mechanics, we successfully scaled the product to $200M+ in Total Value Locked (TVL) within six months, establishing a new gold standard for capital efficiency in the digital asset ecosystem.

Industry Context

1. Stablecoin Revolution

Stablecoins have transitioned from simple "on-ramps" to the foundational infrastructure of global digital finance. However, the industry is shifting from Phase 1 (Static Liquidity)—where capital sits idle—to Phase 2 (Productive Capital). In a high-interest-rate environment, holders no longer accept zero-yield assets; they demand native returns without compromising the 1:1 fiat peg.

2. Institutional Adoption

The thesis for institutional stablecoins is no longer theoretical. TradFi giants are now moving trillions onto the blockchain:

BlackRock (BUIDL): BlackRock launching tokenized money market funds on public blockchains, integrating stablecoin-compatible settlement——The launch of the BlackRock USD Institutional Digital Liquidity Fund (BUIDL) .

PayPal (PYUSD): The integration of PYUSD across global payment rails demonstrates the shift of stablecoins from speculative trading tools to mainstream commerce settlements.

Stablecoins are no longer a crypto-native experiment.

They are becoming programmable digital dollars embedded into institutional finance.

3. Regulatory Maturation

Regulatory clarity has accelerated across major jurisdictions.

U.S. Clarity for Payment Stablecoins Act: Providing a clear federal pathway for stablecoin issuers, ensuring consumer protection and operational reserves transparency.

Europe’s MiCA (Markets in Crypto-Assets): The world’s first comprehensive crypto-asset framework, setting strict standards for asset-referenced tokens and ensuring market integrity across the EU.

Stablecoins are transitioning from regulatory ambiguity to regulated infrastructure.

The Aspiration

Against this backdrop, the client sought to design a yield-bearing stablecoin capable of:

Sustainable Yield: Delivering sustainable, market-neutral yield.

Price Stability: Preventing de-pegging events during extreme market volatility.

Institutional Trust: Bridging the gap between DeFi's transparency and TradFi's risk rigor.

Impact

These results were achieved through a disciplined product design that embedded risk-managed yield generation, clear asset segregation, and governance controls into the stablecoin structure. By aligning financial mechanics, infrastructure choices, and launch execution from the outset, the product scaled quickly without compromising stability or user trust.

Strategic Mandate & Execution

We worked alongside the client from strategic validation to full protocol launch, delivering an integrated intervention across four pillars:

1. Strategic Foundation & Product Thesis

Validated the business case for a yield-bearing stablecoin in the evolving rate environment

Conducted deep structural analysis of existing models (synthetic dollars, RWA-backed models, funding-rate capture strategies)

Defined a differentiated value proposition anchored in capital efficiency and risk transparency

Structured institutional and retail positioning strategy

2. Delta-Neutral Yield Architecture

We engineered a market-neutral treasury framework designed to generate sustainable yield without directional crypto exposure:

Spot–perpetual basis trades

Funding rate arbitrage

Dynamic exposure rebalancing

Embedded automated risk controls

Scenario stress testing under volatility spikes

The result: yield generation driven by structural market inefficiencies — not speculative asset appreciation.

3. Institutional-Grade Infrastructure & Custody

Designed secure, segregated custody architecture

Structured asset isolation to reduce counterparty risk

Implemented transparent treasury monitoring mechanisms

Embedded real-time risk visibility frameworks

This aligned on-chain transparency with TradFi risk discipline.

4. Product Execution & Liquidity Scaling

Built the full on-chain stablecoin stack

Coordinated smart contract deployment and treasury operations

Designed tokenomics and incentive alignment

Led phased go-to-market execution

Activated exchange, liquidity, and ecosystem partnerships

Related Capabilities

Web3 & Digital Asset Strategy

RWA & Stablecoin Design

Product Launch & Go-To-Market

Financial product design

Overview

We partnered with a Tier-1 exchange to architect and launch a next-generation Yield-Bearing Stablecoin. By harmonizing institutional-grade risk management with innovative yield mechanics, we successfully scaled the product to $200M+ in Total Value Locked (TVL) within six months, establishing a new gold standard for capital efficiency in the digital asset ecosystem.

Industry Context

1. Stablecoin Revolution

Stablecoins have transitioned from simple "on-ramps" to the foundational infrastructure of global digital finance. However, the industry is shifting from Phase 1 (Static Liquidity)—where capital sits idle—to Phase 2 (Productive Capital). In a high-interest-rate environment, holders no longer accept zero-yield assets; they demand native returns without compromising the 1:1 fiat peg.

2. Institutional Adoption

The thesis for institutional stablecoins is no longer theoretical. TradFi giants are now moving trillions onto the blockchain:

BlackRock (BUIDL): BlackRock launching tokenized money market funds on public blockchains, integrating stablecoin-compatible settlement——The launch of the BlackRock USD Institutional Digital Liquidity Fund (BUIDL) .

PayPal (PYUSD): The integration of PYUSD across global payment rails demonstrates the shift of stablecoins from speculative trading tools to mainstream commerce settlements.

Stablecoins are no longer a crypto-native experiment.

They are becoming programmable digital dollars embedded into institutional finance.

3. Regulatory Maturation

Regulatory clarity has accelerated across major jurisdictions.

U.S. Clarity for Payment Stablecoins Act: Providing a clear federal pathway for stablecoin issuers, ensuring consumer protection and operational reserves transparency.

Europe’s MiCA (Markets in Crypto-Assets): The world’s first comprehensive crypto-asset framework, setting strict standards for asset-referenced tokens and ensuring market integrity across the EU.

Stablecoins are transitioning from regulatory ambiguity to regulated infrastructure.

The Aspiration

Against this backdrop, the client sought to design a yield-bearing stablecoin capable of:

Sustainable Yield: Delivering sustainable, market-neutral yield.

Price Stability: Preventing de-pegging events during extreme market volatility.

Institutional Trust: Bridging the gap between DeFi's transparency and TradFi's risk rigor.

Impact

These results were achieved through a disciplined product design that embedded risk-managed yield generation, clear asset segregation, and governance controls into the stablecoin structure. By aligning financial mechanics, infrastructure choices, and launch execution from the outset, the product scaled quickly without compromising stability or user trust.

Strategic Mandate & Execution

We worked alongside the client from strategic validation to full protocol launch, delivering an integrated intervention across four pillars:

1. Strategic Foundation & Product Thesis

Validated the business case for a yield-bearing stablecoin in the evolving rate environment

Conducted deep structural analysis of existing models (synthetic dollars, RWA-backed models, funding-rate capture strategies)

Defined a differentiated value proposition anchored in capital efficiency and risk transparency

Structured institutional and retail positioning strategy

2. Delta-Neutral Yield Architecture

We engineered a market-neutral treasury framework designed to generate sustainable yield without directional crypto exposure:

Spot–perpetual basis trades

Funding rate arbitrage

Dynamic exposure rebalancing

Embedded automated risk controls

Scenario stress testing under volatility spikes

The result: yield generation driven by structural market inefficiencies — not speculative asset appreciation.

3. Institutional-Grade Infrastructure & Custody

Designed secure, segregated custody architecture

Structured asset isolation to reduce counterparty risk

Implemented transparent treasury monitoring mechanisms

Embedded real-time risk visibility frameworks

This aligned on-chain transparency with TradFi risk discipline.

4. Product Execution & Liquidity Scaling

Built the full on-chain stablecoin stack

Coordinated smart contract deployment and treasury operations

Designed tokenomics and incentive alignment

Led phased go-to-market execution

Activated exchange, liquidity, and ecosystem partnerships

Related Capabilities

Web3 & Digital Asset Strategy

RWA & Stablecoin Design

Product Launch & Go-To-Market

Financial product design

Interested in similar results for your organization?

Find out more.

Schedule a Virtual Session

Virtual strategy sessions available globally by appointment.

New York Headquarters

340 Madison Ave, New York, NY

Schedule a Virtual Session

Virtual strategy sessions available globally by appointment.

New York Headquarters

340 Madison Ave, New York, NY

Schedule a Virtual Session

Virtual strategy sessions available globally by appointment.

New York Headquarters

340 Madison Ave, New York, NY