Client

A Global Logistics Company

Reducing Cross-Border Payment Costs by <1% for a Global Logistics Company

A global logistics company reduced cross-border payment costs to under 1% by launching a stablecoin-powered payment solution for its SME clients.

Overview

A global logistics company reduced cross-border payment costs to under 1% by launching a stablecoin-powered payment solution for its SME clients.

Industry Context

Stablecoins are not merely crypto-native tools.

They are becoming an alternative global settlement layer.

For SME clients in emerging markets, international payments are often:

Slow (2–5 business days)

Expensive (3–7% total effective cost including FX spreads and intermediary fees)

Operationally complex (multiple banking counterparties, reconciliation friction)

At the same time, global stablecoin adoption has introduced a new settlement layer:

24/7 programmable transfers

Near-instant settlement

Transparent ledger visibility

Significantly reduced intermediary costs

However, most Web2 enterprises lack the regulatory, product, and infrastructure capabilities to translate this into a production-grade solution.

The Aspiration

The client sought to:

Reduce cross-border payment costs for SME customers

Accelerate settlement cycles across key trade corridors

Unlock new payment routes in regions underserved by correspondent banking

Gain better transaction visibility to enable cross-selling and embedded finance

Modernize infrastructure without disrupting core logistics operations

This was not a crypto experiment.

It was an operating model transformation.

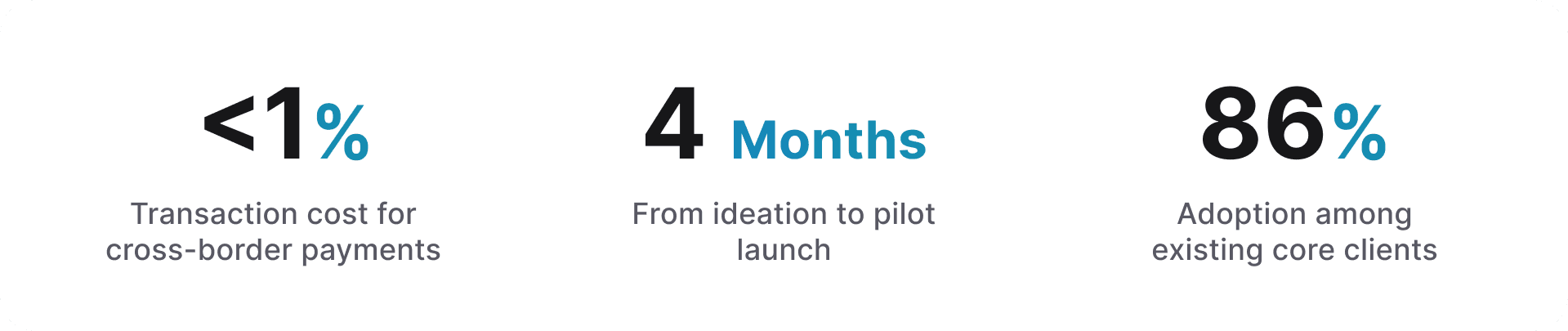

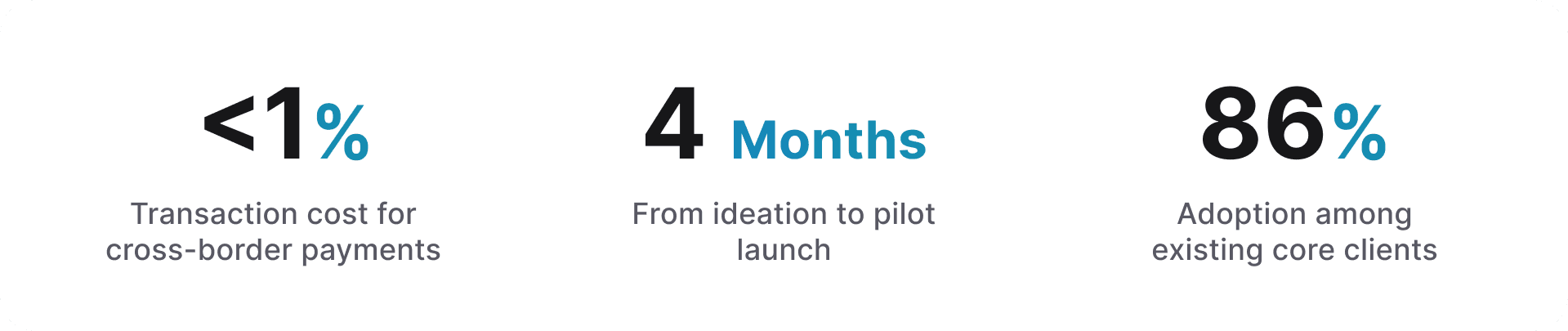

Impact

The solution combined clear use-case definition with a production-ready operating model, enabling rapid deployment across multiple corridors. By aligning product design, regulatory considerations, and ecosystem partnerships early, the company delivered measurable cost savings while strengthening customer engagement and expanding service offerings.

Strategic Mandate & Execution

We worked alongside the client from strategic validation to pilot launch, translating stablecoin infrastructure into an enterprise-grade payment system.

Our intervention spanned three integrated phases.

1. Strategy & Business Case Design

We began with structural validation:

Assessed payment volume flows across corridors

Modeled cost differentials vs. traditional correspondent banking

Quantified FX spread leakage and settlement delays

Identified corridor prioritization based on regulatory feasibility

We defined the target operating model:

Stablecoin as settlement rail, not speculative asset

Hybrid on/off-ramp design

Treasury management framework

Compliance architecture aligned with UAE and corridor jurisdictions

2. Product Architecture & Operating Blueprint

We designed a production-ready operating structure:

End-to-end payment workflow mapping

Stablecoin custody and treasury flows

Counterparty risk controls

Corridor-based liquidity provisioning strategy

Partner identification (custody, exchanges, liquidity providers)

We structured:

On-chain settlement mechanics

Fiat conversion layers

Reconciliation logic integrated into existing ERP systems

Governance and internal control frameworks

3. Launch Execution & Corridor Deployment

We led the pilot deployment:

Prioritized high-friction trade corridors

Structured phased rollout

Activated ecosystem partnerships

Designed client onboarding strategy

Built monitoring dashboards for cost and settlement performance

Related Capabilities

Web3 & Digital Asset Strategy

Stablecoin Design & Treasury Structuring

Product Launch & Go-To-Market

Overview

A global logistics company reduced cross-border payment costs to under 1% by launching a stablecoin-powered payment solution for its SME clients.

Industry Context

Stablecoins are not merely crypto-native tools.

They are becoming an alternative global settlement layer.

For SME clients in emerging markets, international payments are often:

Slow (2–5 business days)

Expensive (3–7% total effective cost including FX spreads and intermediary fees)

Operationally complex (multiple banking counterparties, reconciliation friction)

At the same time, global stablecoin adoption has introduced a new settlement layer:

24/7 programmable transfers

Near-instant settlement

Transparent ledger visibility

Significantly reduced intermediary costs

However, most Web2 enterprises lack the regulatory, product, and infrastructure capabilities to translate this into a production-grade solution.

The Aspiration

The client sought to:

Reduce cross-border payment costs for SME customers

Accelerate settlement cycles across key trade corridors

Unlock new payment routes in regions underserved by correspondent banking

Gain better transaction visibility to enable cross-selling and embedded finance

Modernize infrastructure without disrupting core logistics operations

This was not a crypto experiment.

It was an operating model transformation.

Impact

The solution combined clear use-case definition with a production-ready operating model, enabling rapid deployment across multiple corridors. By aligning product design, regulatory considerations, and ecosystem partnerships early, the company delivered measurable cost savings while strengthening customer engagement and expanding service offerings.

Strategic Mandate & Execution

We worked alongside the client from strategic validation to pilot launch, translating stablecoin infrastructure into an enterprise-grade payment system.

Our intervention spanned three integrated phases.

1. Strategy & Business Case Design

We began with structural validation:

Assessed payment volume flows across corridors

Modeled cost differentials vs. traditional correspondent banking

Quantified FX spread leakage and settlement delays

Identified corridor prioritization based on regulatory feasibility

We defined the target operating model:

Stablecoin as settlement rail, not speculative asset

Hybrid on/off-ramp design

Treasury management framework

Compliance architecture aligned with UAE and corridor jurisdictions

2. Product Architecture & Operating Blueprint

We designed a production-ready operating structure:

End-to-end payment workflow mapping

Stablecoin custody and treasury flows

Counterparty risk controls

Corridor-based liquidity provisioning strategy

Partner identification (custody, exchanges, liquidity providers)

We structured:

On-chain settlement mechanics

Fiat conversion layers

Reconciliation logic integrated into existing ERP systems

Governance and internal control frameworks

3. Launch Execution & Corridor Deployment

We led the pilot deployment:

Prioritized high-friction trade corridors

Structured phased rollout

Activated ecosystem partnerships

Designed client onboarding strategy

Built monitoring dashboards for cost and settlement performance

Related Capabilities

Web3 & Digital Asset Strategy

Stablecoin Design & Treasury Structuring

Product Launch & Go-To-Market

Interested in similar results for your organization?

Find out more.

Schedule a Virtual Session

Virtual strategy sessions available globally by appointment.

New York Headquarters

340 Madison Ave, New York, NY

Schedule a Virtual Session

Virtual strategy sessions available globally by appointment.

New York Headquarters

340 Madison Ave, New York, NY

Schedule a Virtual Session

Virtual strategy sessions available globally by appointment.

New York Headquarters

340 Madison Ave, New York, NY